The need for home improvement when you look at the Nj cannot end. New jersey homeowners are constantly increasing their rooms, remodeling old rooms, or upgrading devices. Yet not, the requirement to alter your domestic must not be influenced by the newest anxiety about financing that do-it-yourself. A few of these renovations and you may improvements need a life threatening financial investment. Even though particular property owners possess the cash readily available, anyone else will need to discuss investment choice. Do not get overloaded. Financing the next do-it-yourself must not be an intricate clutter.

That is why On the spot Renovations features options for home owners to get their second inform finished. Today we will talk about some some other funding choices for renovations, particularly HELOCs, second mortgage loans, and do-it-yourself money by way of Enhancify.

Currently managed your own capital and able to begin your future domestic update endeavor inside Nj? Get in touch with At that moment Renovations and you can consult with a specialist today.

What exactly is HELOC?

First up, we HELOC, or Household Collateral Personal line of credit. With this alternative, home owners borrow against this new security of its home, delivering a flexible way to obtain money to own a separate do-it-yourself venture. Just like credit cards, HELOC lets people to get into finance as needed, and only pay notice on the amount one gets payday loan Kimberly borrowed. That one usually has a lower initial interest rate than many other forms of borrowing from the bank, and also make HELOCs a payment-energetic option for money.

More often than not, notice paid back into a beneficial HELOC can be taxation-allowable if your money are used for home improvement. Nj homeowners should think about which more benefit of HELOCs started taxation big date.

When you find yourself HELOCs tend to provide less initial interest rate, these types of rates are typically changeable and will change, that may result in high monthly obligations when the interest rates rise. People plus run the risk regarding property foreclosure on the house in the event the it neglect to repay the HELOC. Please remember the individuals annoying settlement costs and charge. For example appraisal costs, software fees, and annual repairs fees. These fees is also sneak up with the home owners and you can incorporate up over realized.

Consider a moment Financial

You to definitely choice for Nj-new jersey home owners to look at is actually an additional financial to finance their 2nd home improvement enterprise. Remember, yet not, of the positives and negatives associated with solution.

Perhaps you have sensed getting a second home loan? Just like HELOCs, these mortgage loans allow home owners to borrow against the newest guarantee of their family. Yet not, instead of a line of credit, the next home loan provides a lump sum payment initial. This is exactly good choice for Nj-new jersey residents trying to funds reasonable do-it-yourself systems otherwise consolidate debt.

Another type of difference from HELOCs is the fact next mortgage loans usually give fixed rates of interest instead of variable rates, giving better balances and predictability from the homeowner’s monthly obligations. 2nd mortgages can come having expanded fees terminology compared to other kinds of borrowing from the bank, allowing homeowners so you can dispersed its payments and maybe enjoys a beneficial down payment.

Once again, just as in HELOCs, second mortgages run the dangers of foreclosures to have incapacity to help you pay and worrisome closure fees. There’s also the possibility of more credit. With a massive lump sum, many home owners tends to be inclined to save money than they’re able to afford, which makes them collect more obligations than simply they’re able to comfortably shell out. If you choose a moment mortgage, remember to obtain responsibly and consider your long-name financial requires.

Home improvement Borrowing from the bank Solutions

Nj-new jersey residents have some other borrowing choice, for example handmade cards and private financing. These types of options give simple and fast the means to access money and you will freedom in financing solutions. Nevertheless they typically don’t require equity, including house collateral, in the place of HELOCs otherwise second mortgages.

And these types of positives, New jersey residents should be aware of any possible cons to using credit solutions eg playing cards or signature loans. For example, they typically were large interest rates than other capital options, leaving home owners which have large monthly premiums. They might also include reduced fees words, placing extra strain on cash. Nj-new jersey property owners provided such credit choice should look getting aggressive costs and versatile installment selection.

When it comes to these credit selection, residents should routine several good economic models to cope with the credit intelligently. Cost management is essential, and you may any citizen should perform reveal finances explaining project will set you back prior to taking to your obligations getting renovations. Staying charge card balances reasonable is a good behavior helping to get rid of maxing aside borrowing from the bank restrictions. This will help with monthly obligations, and you will a great habit with the help of our is to try to shell out promptly to stop late charge in order to maintain a positive credit score.

Opening Enhancify

With all of these types of selection, it might seem challenging to choose what exactly is suitable for your future home improvement opportunity inside the Nj-new jersey. It is very important speak about a number of options and you can think about your individual problem and requires.

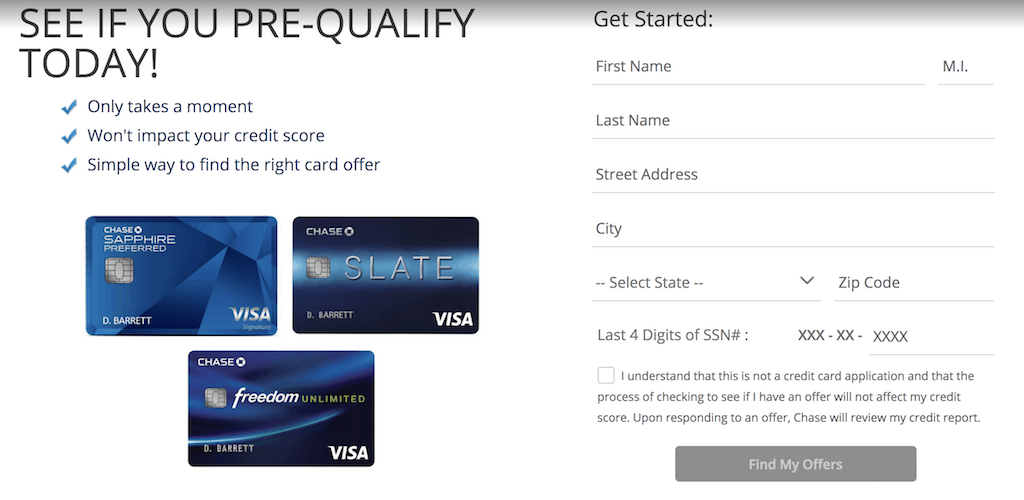

Immediately Renovations have partnered that have Enhancify to offer Nj-new jersey homeowners resource options for new home improve systems. Enhancify is a trusted on line platform one to links residents with legitimate loan providers, so it is simple to find aggressive loan now offers tailored in order to personal demands. They have basic the application process to be certain that a silky and you will difficulty-totally free sense. Along with the large community from lenders, home owners provides numerous loan solutions within the disposal.

Contemplate, view competitive cost and flexible fee choice prior to paying down. Enhancify supports this step because of the focusing on investment choices that will better suit your needs. After acknowledged, money from Enhancify money are typically spreading easily, enabling homeowners to maneuver pass the help of its home improvement preparations rather than impede.

Get it done

Do it yourself financial support takes on a crucial role when you look at the growing the traditions place, renovating an old place, upgrading equipment, or whichever your following opportunity you’ll involve. Nj homeowners has actually various options available to them, be it as a consequence of HELOCs, next mortgage loans, otherwise borrowing from the bank solutions compliment of Enhancify. Of the weigh advantages and you can cons of every alternative, property owners can also be judge which makes the very feel in their eyes.

On At that moment Home improvements, the audience is purchased providing home owners in the New jersey started to their house improvement requirements thanks to obtainable and flexible financing possibilities. Talk about Enhancify right now to uncover what options are on the market.

As you prepare first off one to next do-it-yourself investment, visit Immediately Home improvements and you can speak to a specialist about turning the new sight to the reality.

دیدگاه خود را بنویسید